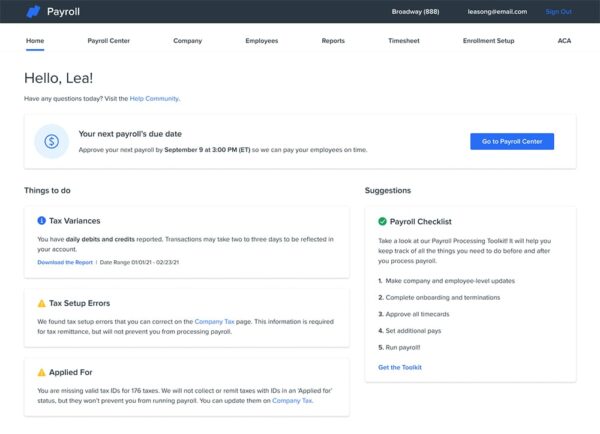

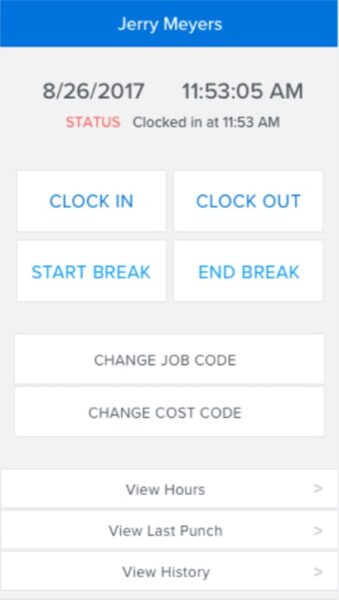

Yes! Payroll laws, especially when managing a multi-state workforce, can be difficult. It’s essential to mitigate risk by making sure you are staying compliant with laws and regulations, such as the Equal Employment Opportunity Commission (EEOC), Fair Labor Standards Act (FLSA), and the Department of Labor. The right payroll system can help ease these concerns through creating rules and customization within the platform, and ensuring reports are filed correctly and punctually.

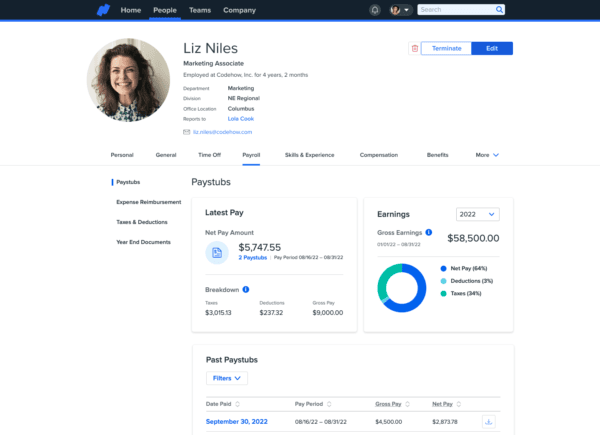

Additionally, with Namely, your business has a comprehensive tax management feature, which automatically calculates the federal, state, local, and other tax that is deducted from each paycheck. It can also automatically calculate any changes in tax code and actually pay and file taxes on the company’s behalf. This feature is a critical step for ensuring accuracy, complying with tax codes, and keeping them up to date. Regardless of which payroll system you use, your company will be responsible for accurate reporting and payment of payroll taxes.